south san francisco sales tax rate 2020

San Francisco County CA Sales Tax Rate. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

How Do State And Local Sales Taxes Work Tax Policy Center

The current total local sales tax rate in South San Francisco CA is 9875.

. Most of these tax changes were approved by voters in the November 2020 election the California Department of. Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local.

The minimum combined 2020 sales tax rate for South San Francisco California is 975. What is the sales tax rate in South San Francisco California. The San Francisco County sales tax rate is.

The 2018 United States Supreme Court decision in South Dakota v. The December 2020 total local sales tax rate was 8500. South San Jose Hills CA Sales Tax Rate.

The South San Francisco California sales tax is 750 the same as the California state sales tax. Presidio of Monterey Monterey 9250. The December 2020 total.

1788 rows California City County Sales Use Tax Rates effective April 1 2022. South Pasadena CA Sales Tax Rate. The current total local sales tax rate in San Francisco County CA is 8625.

This is the total of state county and city sales tax rates. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. The California state sales tax rate is currently 6.

The south san francisco california sales tax is 750 the same as the california state sales tax. The California sales tax rate is currently 6. The 9875 sales tax rate in South San Francisco consists of 6 Puerto Rico state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

The December 2020 total local sales tax rate was 8500. The hike came after voters passed two 05 percent tax hikes in 2020. South Shore CA Sales Tax Rate.

The 9875 sales tax rate in South San Francisco consists. Has impacted many state nexus laws and sales tax collection. This is the total of state county and city sales.

South Taft CA Sales Tax Rate. South san jose hills ca sales tax rate. South San Francisco CA Sales Tax Rate.

Download all California sales tax rates by zip code. There is no applicable city tax. South San Francisco CA Sales Tax Rate.

South San Gabriel CA Sales Tax Rate. South Whittier CA Sales Tax Rate. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

The California sales tax rate is currently. While many other states allow counties and other localities to collect a local option sales tax. The San Francisco County Sales Tax is 025.

The minimum combined 2022 sales tax rate for South San Francisco California is. The current total local sales tax rate in San Francisco CA is 8625. The san francisco sales tax rate is 0.

South San Francisco CA Sales Tax Rate. This is the total of state county and city sales tax rates. A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax.

San Francisco CA Sales Tax Rate. The minimum combined 2022 sales tax rate for San Francisco California is. The local sales tax rate in south san francisco california is 9875 as of november 2021.

The December 2020 total local sales tax rate was 9750. In San Francisco the tax rate will rise from 85 to 8625. Tax returns are required monthly for all.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. South Woodbridge CA Sales Tax Rate.

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Do State And Local Sales Taxes Work Tax Policy Center

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

What Is The True Cost Of Living In San Francisco Smartasset

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

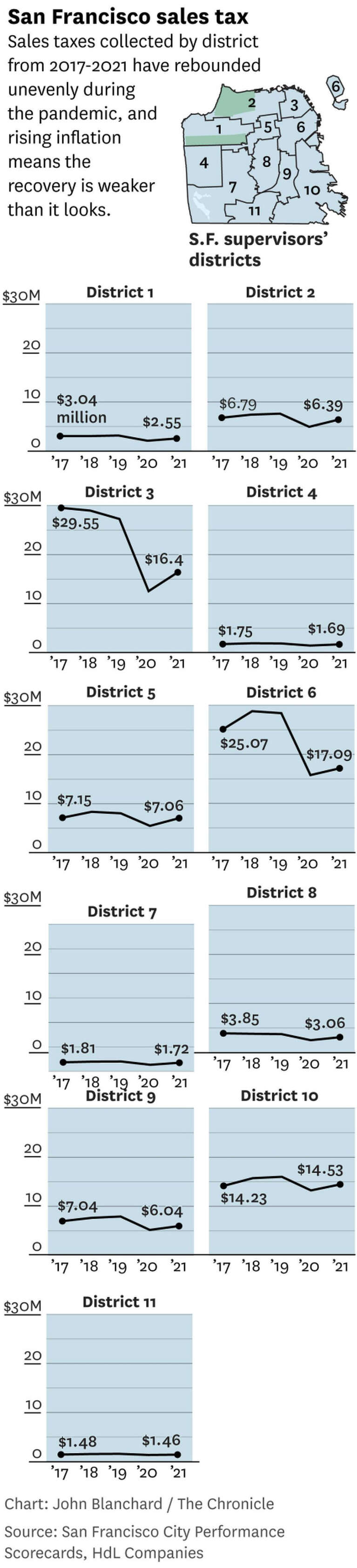

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Frequently Asked Questions City Of Redwood City

California Sales Tax Rates By City County 2022

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Why Households Need 300 000 To Live A Middle Class Lifestyle

House Prices In San Francisco Bay Area Experience Steep Declines From April Peak Craziness Down Year Over Year Wolf Street

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom